Deducting Home Office Expenses 2024 – eliminating the home office deduction for people who work for an employer. However, it’s scheduled to expire in 2026. So, if you’re an employee, your home office expenses are not tax deductible — even . Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax .

Deducting Home Office Expenses 2024

Source : www.freshbooks.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.comHow to file your taxes for free this season

Source : www.cnbc.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.comHow to file your taxes for free this season

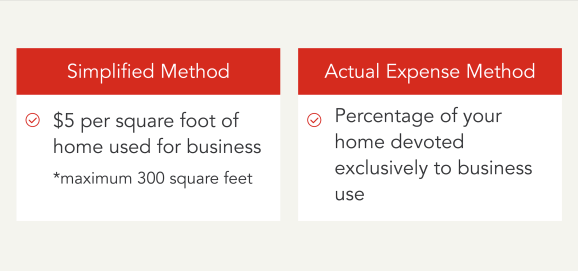

Source : www.cnbc.comDeducting Home Office Expenses 2024 25 Small Business Tax Deductions To Know in 2024: That means your itemized expenses for 2023 will need to total If your business meets IRS requirements for a home office, you can deduct a percentage of the above based on the square footage . The Saver’s Credit, part of last year’s Secure Act 2.0, works this way: Along with contributing to a retirement account and receiving the deduction for doing so, you may be able to snag an additional .

]]>